© ROOT-NATION.com - Use of content is permitted with a backlink.

Ready to elevate your trading game? Mastering advanced options strategies like iron condors, butterfly spreads, and calendar spreads can open new profit avenues. These techniques, designed for savvy traders, provide ways to manage risk and maximize returns. Dive into this guide to transform your trading approach and navigate the market with confidence. If you are serious about learning investing, Visit quantumlumina.com/ and connect with an education firm to learn about investing right from the word go! Register now and get started with investment education!

Exploring the Iron Condor Strategy

What is an Iron Condor?

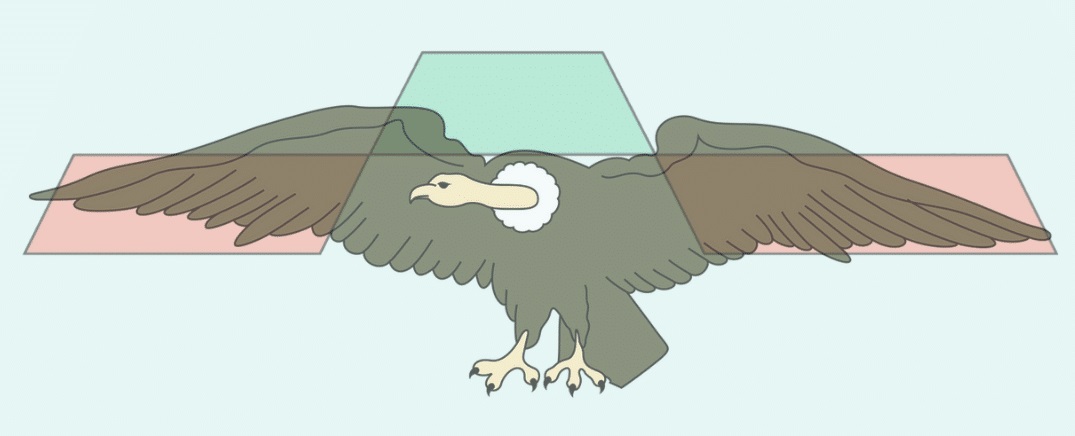

An iron condor is a popular options strategy used by traders seeking steady income with limited risk. It involves four different options contracts, combining two vertical spreads (one call spread and one put spread). This setup creates a profit zone between the strike prices of the spreads. The goal is to capitalize on low volatility in the market.

Step-by-Step Breakdown: Constructing an Iron Condor

- Select Your Underlying Asset: Choose a stock or index with low volatility.

- Determine Your Strike Prices: Identify two call strikes (one higher, one lower) and two put strikes (one higher, one lower). These should be equidistant from the current price.

- Sell the Inner Options: Sell a call at the lower strike price and a put at the higher strike price.

- Buy the Outer Options: Buy a call at the higher strike price and a put at the lower strike price.

- Set Expiration Dates: Ensure all options have the same expiration date.

To boost profits with an iron condor, keep these tips in mind:

- Choose the Right Time: Execute the strategy when market volatility is low.

- Adjust as Needed: If the market moves, adjust the strikes to stay within the profit zone.

- Monitor the Market: Keep an eye on market conditions and be ready to exit if volatility increases.

Case Studies: Real-World Applications of Iron Condors

Consider this example: A trader selects an index currently trading at $100. They sell a call at $105, buy a call at $110, sell a put at $95, and buy a put at $90. If the index remains between $95 and $105 until expiration, the trader retains the premium received, maximizing profit. Another case might involve adjusting the strikes if the index starts to move, ensuring the strategy remains profitable.

Decoding the Butterfly Spread Strategy

The Fundamentals of a Butterfly Spread

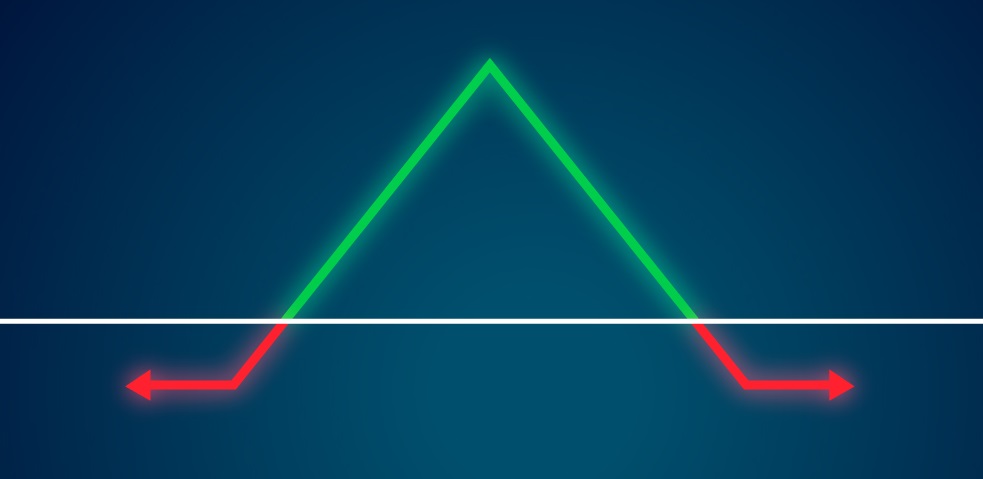

A butterfly spread is an options strategy designed to profit from minimal movement in the underlying asset. It involves three strikes: buying one option at the lower strike, selling two options at the middle strike, and buying one option at the higher strike. This strategy creates a profit peak at the middle strike price.

Variations: Long Butterfly vs. Short Butterfly

- Long Butterfly: This is the classic version. The trader expects little movement in the underlying asset and aims to profit from it staying around the middle strike price.

- Short Butterfly: This variant involves selling a butterfly spread. The trader benefits from significant movement in the underlying asset, expecting it to move away from the middle strike price.

Strategy Optimization: When and How to Deploy Butterfly Spreads

Use butterfly spreads in low-volatility environments. For a long butterfly, enter the trade when the asset price is near the middle strike. For a short butterfly, execute the trade when expecting significant movement. Adjust the strikes to fit your market outlook and risk tolerance.

Example Scenarios: Butterfly Spread in Action

Imagine a stock trading at $50. A trader executes a long butterfly by buying one call at $45, selling two calls at $50, and buying one call at $55. If the stock stays close to $50 until expiration, the trader profits. Conversely, for a short butterfly, if the stock moves significantly away from $50, the trader benefits.

Introduction to Calendar Spreads

A calendar spread involves buying and selling two options of the same type (calls or puts) with the same strike price but different expiration dates. This strategy profits from changes in volatility and time decay.

Comparing Calendar Spreads: Horizontal vs. Diagonal

- Horizontal Calendar Spread: Both options have the same strike price but different expiration dates.

- Diagonal Calendar Spread: The options have different strike prices and different expiration dates.

Timing the Market: Leveraging Calendar Spreads for Volatility

Calendar spreads work best in low to moderate volatility environments. Enter the trade when expecting stability in the underlying asset’s price but increased volatility in the near term. The goal is to profit from time decay on the short-term option while holding the longer-term option.

Practical Examples: Successful Calendar Spread Implementations

Consider a trader using a horizontal calendar spread on a stock trading at $100. They buy a long-term call option expiring in six months at a $100 strike price and sell a short-term call option expiring in one month at the same strike price.

If the stock price remains stable, the short-term option decays faster, yielding a profit. For a diagonal spread, the trader might buy a long-term call at $105 and sell a short-term call at $100, profiting from both time decay and potential price movement.

Final Thoughts

When engaging in advanced options strategies like iron condors, butterfly spreads, and calendar spreads, it’s crucial to understand the mechanics and carefully monitor the market. Experiment with different setups and seek advice from financial experts to enhance your trading skills. Always remember to do thorough research and adapt strategies to your specific financial goals.