© ROOT-NATION.com - Use of content is permitted with a backlink.

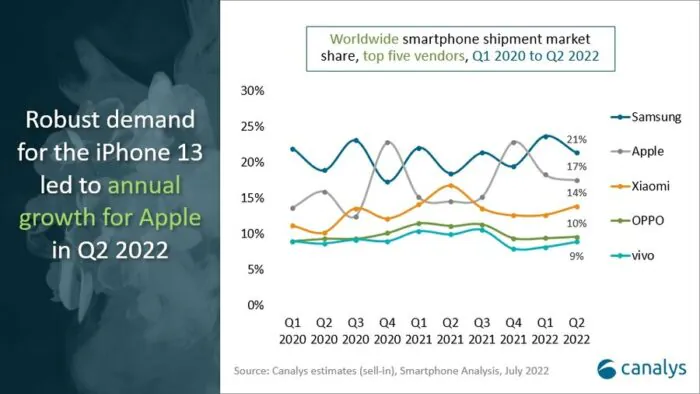

Canalys has published an alarming report on the global smartphone market for Q2’22. Shipments between April and June droped 9% year-on-year due to lower demand caused by “economic headwinds and regional uncertainty.” Samsung took the top spot with a 21% market share, bolstering the supply of low-cost A-series models. Apple came in second with a 17% share as demand for the iPhone 13 remained strong. Xiaomi, OPPO and vivo continued to struggle in China, experiencing double-digit declines and capturing 14%, 10% and 9% of the market respectively.

According to Runar Bjørhovde, Canalys Research Analyst, companies have faced sluggish demand, which has led to a rethinking of quarterly strategies. The rapid rise in inflation and the build-up of stocks has caused producers to “revaluate their portfolio” for the rest of 2022.

The mid-range smartphone segment is struggling more than expected. It tends to be overcrowded, and now sales are even more sluggish as consumers tend to look for even cheaper devices. The drop in demand is causing serious concerns throughout the supply chain, added Canalys Analyst Toby Zhu. The price pressure is easing, but the logistics and production problem still exists. For example, tighter import laws and customs procedures in some emerging markets are leading to further delays in shipments.

The 9% decline is also due to extremely high demand twelve months ago. There was delayed demand after a difficult 2020, while today’s consumer disposable income is being spent on other products and goods rather than electronics.

“While component supplies and cost pressures are easing, a few concerns remain within logistics and production, such as some emerging markets’ tightening import laws and customs procedures delaying shipments. In the near term, vendors will look to accelerate sell-through using promotions and offers ahead of new launches during the holiday season to alleviate the channel’s liquidity pressure. But in contrast to last year’s pent-up demand, consumers’ disposable income has been affected by soaring inflation this year. Deep collaboration with channels to monitor the state of inventory and supply will be vital for vendors to identify short-term opportunities while maintaining healthy channel partnerships in the long run,” Canalys Analyst Toby Zhu added.

You can also help Ukraine fight with Russian occupants via Savelife or via an official page of the National Bank of Ukraine.